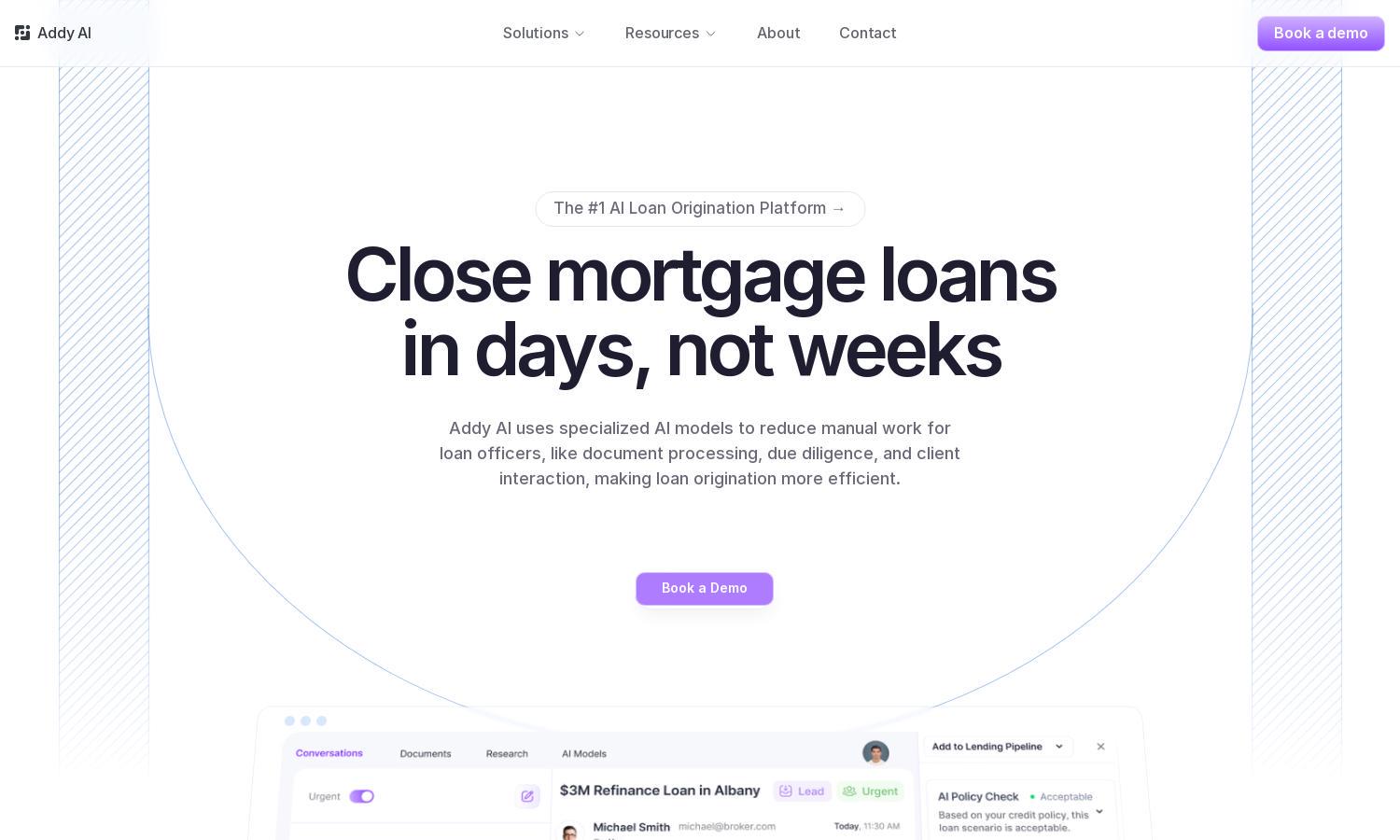

Addy AI

About Addy AI

Addy AI is a powerful platform designed for mortgage lenders, automating the loan origination process to significantly reduce manual work. With specialized AI models, users can achieve faster loan processing, improve document handling, and enhance client communication, resulting in greater efficiency and client satisfaction.

Addy AI offers flexible pricing plans tailored for all mortgage lenders, ensuring access to essential features at various tiers. Each subscription level delivers added benefits and efficiency, with potential discounts for annual commitments, enhancing value and making upgrading attractive for users seeking advanced capabilities.

Addy AI features a user-friendly interface that simplifies mortgage lending processes. Its intuitive layout facilitates easy navigation through core functionalities, from document processing to client communications, providing a seamless experience for users. Enhanced design elements ensure accessibility and efficiency, driving user satisfaction throughout the platform.

How Addy AI works

To start using Addy AI, users onboard by creating an account and integrating their systems, such as CRMs and loan origination software. The platform guides users through training custom AI models for document processing and client interactions, making it easy to automate these repetitive tasks. Users can leverage instant loan assessments and follow up with clients effectively, enhancing the overall mortgage lending experience with minimal manual effort.

Key Features for Addy AI

Automated Loan Origination

Addy AI’s automated loan origination feature streamlines the mortgage lending process, dramatically reducing manual tasks for loan officers. By implementing bespoke AI models, users can close loans much faster, increasing efficiency and improving client satisfaction. This innovative functionality is essential for modern lenders.

Seamless CRM Integration

With seamless CRM integration, Addy AI enhances workflow efficiency by automatically syncing and updating loan data. This feature allows lenders to manage client interactions seamlessly and reduce context-switching, enabling more focus on high-priority tasks and improving overall productivity within the mortgage lending process.

Instant Loan Assessments

Addy AI simplifies loan eligibility checks with its instant loan assessment capability. By rapidly analyzing borrowers' profiles against credit policies, it identifies ineligible applicants and offers actionable suggestions for improvement. This feature enhances user experience and aids lenders in making informed decisions quickly.

You may also like: