Chart

About Chart

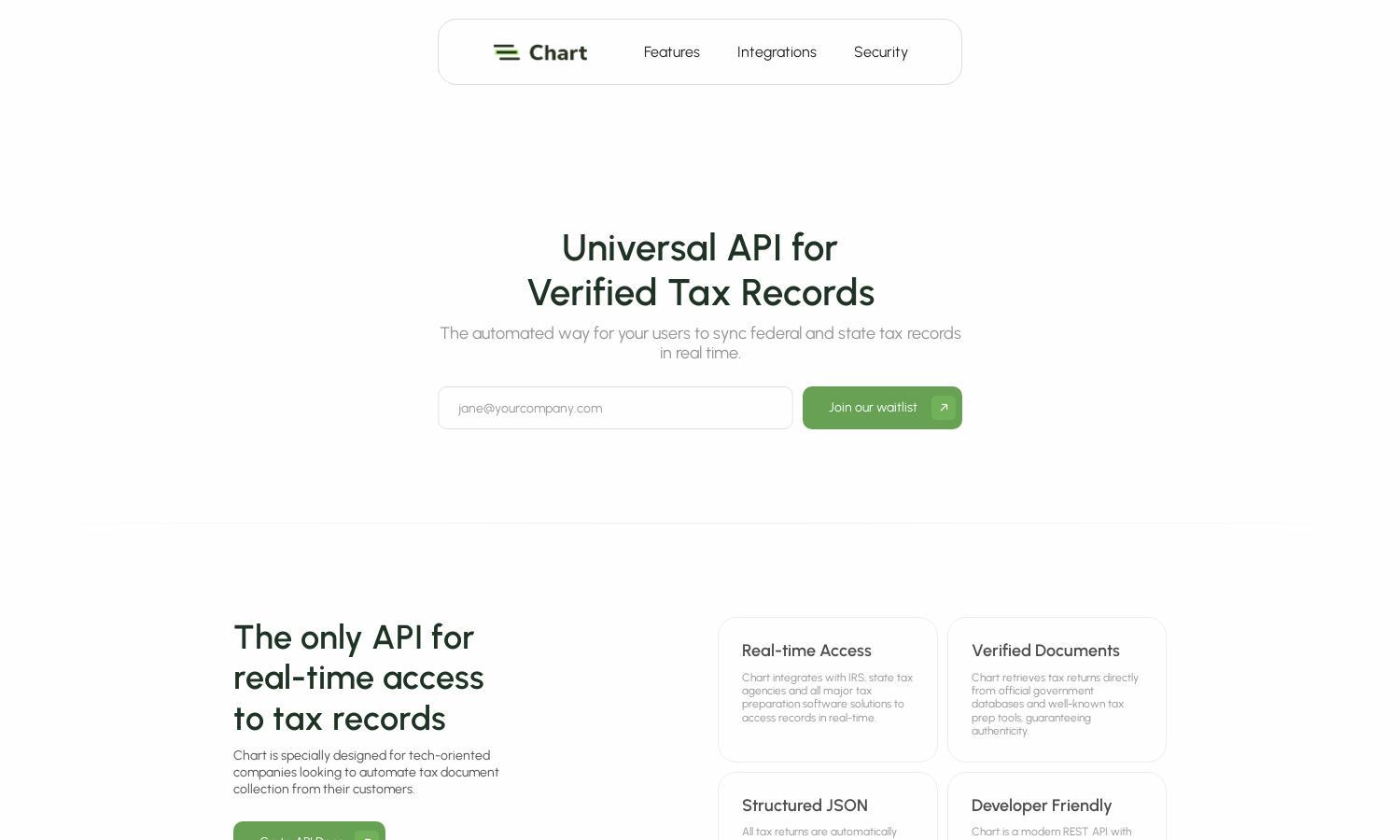

Chart is designed for tech companies seeking efficient tax document automation. Its innovative API provides real-time access to verified tax records, integrating seamlessly with IRS and state systems. This ensures authenticity, enhances user experience, and solves the challenges of tax document collection and compliance.

Chart offers various pricing plans tailored to business needs, ranging from basic to enterprise. Each tier provides increasing access to features such as expanded API calls, dedicated support, and enhanced security options. Upgrading benefits users with greater efficiency and improved tax record management.

Chart's user interface is clean and intuitive, promoting a seamless user experience. The layout guides users effortlessly through document submission and integration processes, while features like structured JSON support optimize data management, making Chart an ideal solution for companies automating tax compliance.

How Chart works

Users begin with onboarding at Chart by creating their accounts and verifying identity. Once registered, they can easily navigate the multi-faceted API, choosing submission options that suit their needs—whether connecting tax accounts, utilizing tax prep software, or uploading documents directly. Chart’s streamlined process and robust security features ensure quick and safe retrieval of verified tax records.

Key Features for Chart

Real-time Access API

The Real-time Access API from Chart provides tech-driven companies with instant connections to verified tax records. This unique functionality facilitates automated retrieval from IRS and state agencies, ensuring authenticity and reducing the administrative burden of tax document collection while enhancing user trust and satisfaction.

Verified Document Retrieval

Chart's Verified Document Retrieval feature guarantees that tax returns are sourced directly from official databases and trusted tax prep tools. This ensures fraud prevention and authenticity, making Chart a reliable partner for companies needing seamless tax document automation and compliance for their users.

Granular Document Access

Granular Document Access enables Chart users to select specific documents to share during the consent process. This unique feature promotes user control over their sensitive data, enhancing security, compliance, and trust, ultimately improving the overall user experience while managing tax record collection efficiently.

You may also like: