Pennyflo

About Pennyflo

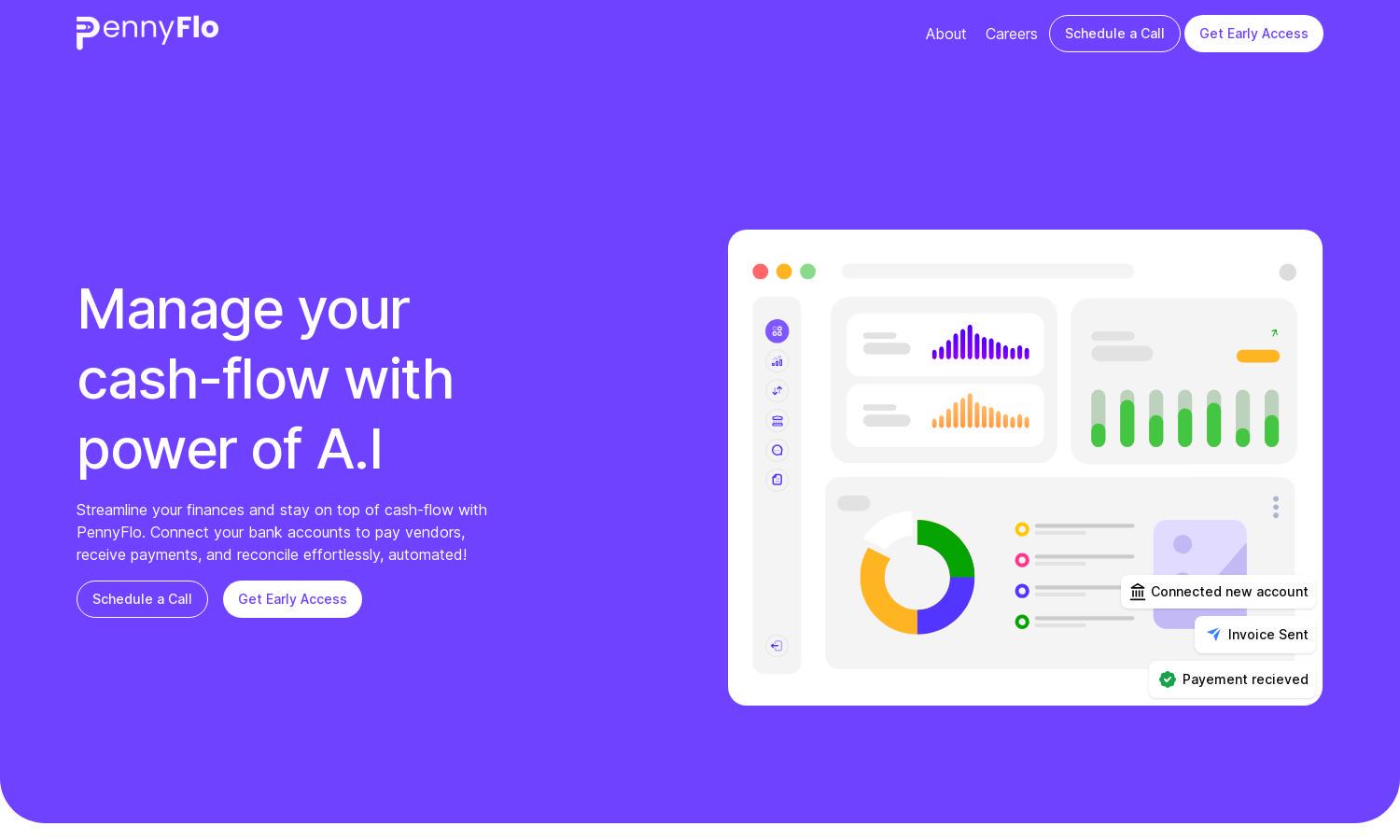

Pennyflo simplifies cash flow management for businesses by providing a unified, real-time view of financial data. Its AI-powered co-pilot facilitates collaboration among finance teams, automating workflows and allowing users to make data-driven decisions. Pennyflo effectively tackles cash shortage risks, ensuring sustainability.

Pennyflo offers flexible pricing plans tailored to different business needs. Each tier provides increasing access to premium features, such as advanced analytics and integrations with popular financial tools. Upgrading enhances usability and support, enabling businesses to optimize their cash management strategies effectively.

Pennyflo's user interface is designed for simplicity and efficiency, ensuring a seamless experience for finance teams. With a clean layout and intuitive navigation, users can easily access features for cash tracking, reporting, and forecasting. The platform prioritizes user-friendliness while remaining powerful and functional.

How Pennyflo works

Upon onboarding with Pennyflo, users can easily navigate the platform to manage cash flow efficiently. The onboarding process includes easy setup and integrations with existing tools. Users can leverage the platform’s real-time data visualization features, automated workflows, and cash forecasting capabilities to make informed financial decisions, ultimately streamlining financial operations.

Key Features for Pennyflo

AI-Powered Co-Pilot

Pennyflo's AI-Powered Co-Pilot is a unique feature that enhances financial teamwork and efficiency. This intelligent assistant automates repetitive tasks, allowing finance teams to focus on strategy and analysis. By streamlining workflows, Pennyflo helps businesses save time and reduce errors in cash management solutions.

Dynamic Forecasting

Pennyflo offers Dynamic Forecasting, an innovative feature that utilizes user data to plan for future financial scenarios. This functionality enables businesses to anticipate cash flow fluctuations, enhancing decision-making capabilities. By providing actionable insights, Pennyflo empowers users to proactively manage their finances and mitigate risks.

Automated Banking & Reconciliations

Automated Banking & Reconciliations is a standout feature of Pennyflo. It simplifies the reconciliation process by automating bank transactions, ensuring accuracy and minimizing manual effort. This feature allows users to maintain a precise cash flow overview, ultimately supporting efficient financial management practices.