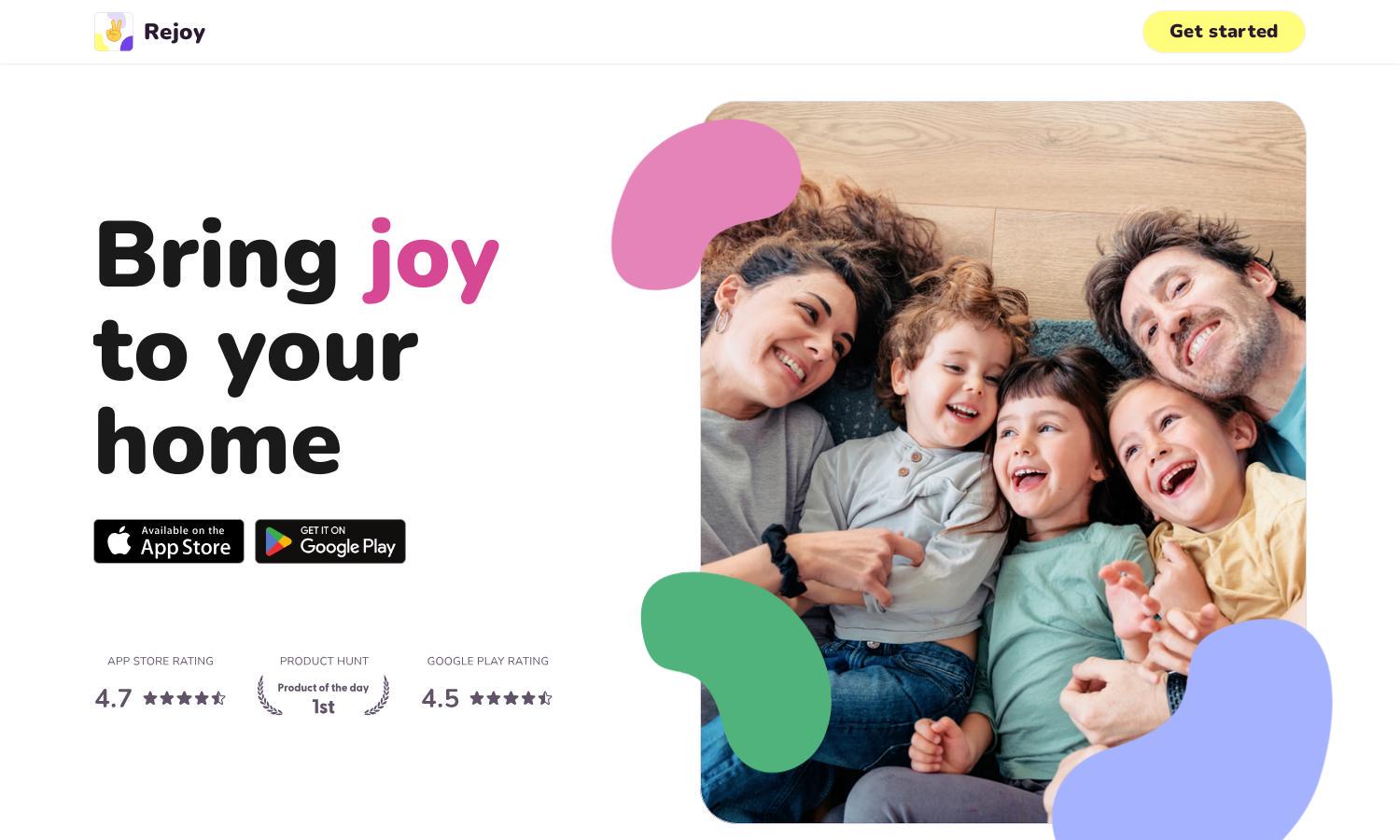

Rejoy

About Rejoy

Rejoy is designed as a comprehensive family organizer and AI assistant. It seamlessly integrates shared calendars, meal planning, and task management, making it ideal for busy households. By promoting collaboration, Rejoy solves daily chaos, allowing families to focus on love and connection.

Rejoy offers a free basic plan, with premium features available through a monthly subscription. Upgrading provides access to advanced financial tools, personalized meal planning, and more. This value-packed approach ensures users can effectively manage their households while enjoying all the app's functionalities.

Rejoy's user interface is intuitively designed for ease of navigation. With a clean layout and straightforward access to family calendars, shopping lists, and task assignments, users can effortlessly organize their lives. Unique features, like shared meal planning, enhance the seamless experience within the app.

How Rejoy works

Users begin by downloading Rejoy and setting up family profiles, linking personal calendars for synchronization. They can then create and manage shared tasks, meal plans, and shopping lists. Through its intuitive interface, Rejoy simplifies organization, allowing families to collaborate and maintain order effortlessly.

Key Features for Rejoy

Shared Family Calendar

The shared family calendar is a standout feature of Rejoy, allowing all family members to sync their personal schedules. This innovative tool ensures everyone is on the same page, reducing conflicts and enhancing family coordination, thus bringing harmony to daily routines.

Effortless Meal Planner

Rejoy’s effortless meal planner provides thousands of recipes, enabling families to plan weekly meals with ease. This feature includes a shared shopping list, simplifying grocery shopping and meal preparation, ultimately saving time and reducing meal-related stress for busy families.

Financial Advisor Sync

Rejoy includes a helpful Financial Advisor sync feature, allowing families to track their bank accounts and manage finances more effectively. This innovative aspect empowers users to achieve financial goals, promoting better financial health and informed decision-making for household budgeting.