TaxGPT

About TaxGPT

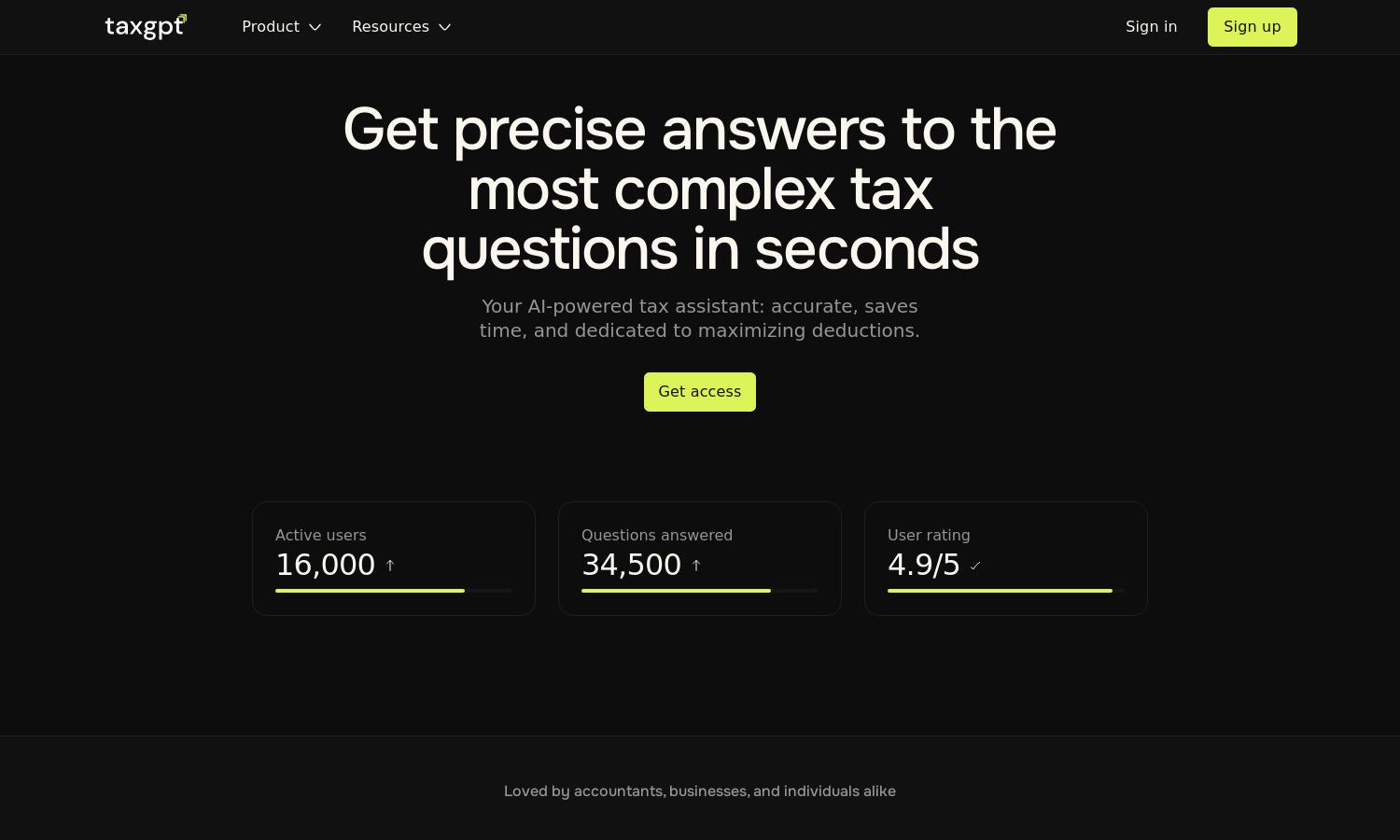

TaxGPT is your ultimate AI tax assistant, created for accountants and tax professionals. With advanced features, it provides precise and timely answers to various tax questions, significantly improving efficiency. By automating research and document management, TaxGPT ensures a streamlined workflow and enhanced productivity for its users.

TaxGPT offers a free 14-day trial with flexible subscription plans. Each tier is designed to cater to different user needs, ensuring access to advanced features and tools. Upgrading enhances user experience, providing premium support and additional functionalities to maximize tax research efficiency.

The user-friendly interface of TaxGPT ensures a seamless experience for tax professionals. Its intuitive layout enhances navigation, allowing users to quickly access tools and resources. With unique features that prioritize clarity and usability, TaxGPT stands out as a go-to platform for tax-related assistance.

How TaxGPT works

Users begin by signing up on TaxGPT, gaining immediate access to its features. The platform guides them through uploading documents and inputting tax queries seamlessly. With AI-driven responses, users can quickly receive insights, memo writing assistance, and more, making tax research efficient and hassle-free.

Key Features for TaxGPT

AI-Powered Tax Answers

TaxGPT delivers instant and accurate answers to complex tax questions, providing a reliable AI-powered assistant. This feature saves time for tax professionals by reducing extensive research efforts, allowing them to focus on higher-value tasks and better serve their clients.

Document Management Tool

TaxGPT's document management tool helps professionals efficiently handle client documents. By simplifying uploads and summaries, this feature ensures a smooth process, enhancing client interactions and saving time on administrative tasks, ultimately contributing to operational efficiency.

Maximized Deductions Feature

The Maximized Deductions feature of TaxGPT identifies eligible deductions, ensuring tax professionals and their clients benefit from potential savings. This unique functionality helps users avoid overpaying taxes while enhancing overall financial decision-making.