Sixfold

About Sixfold

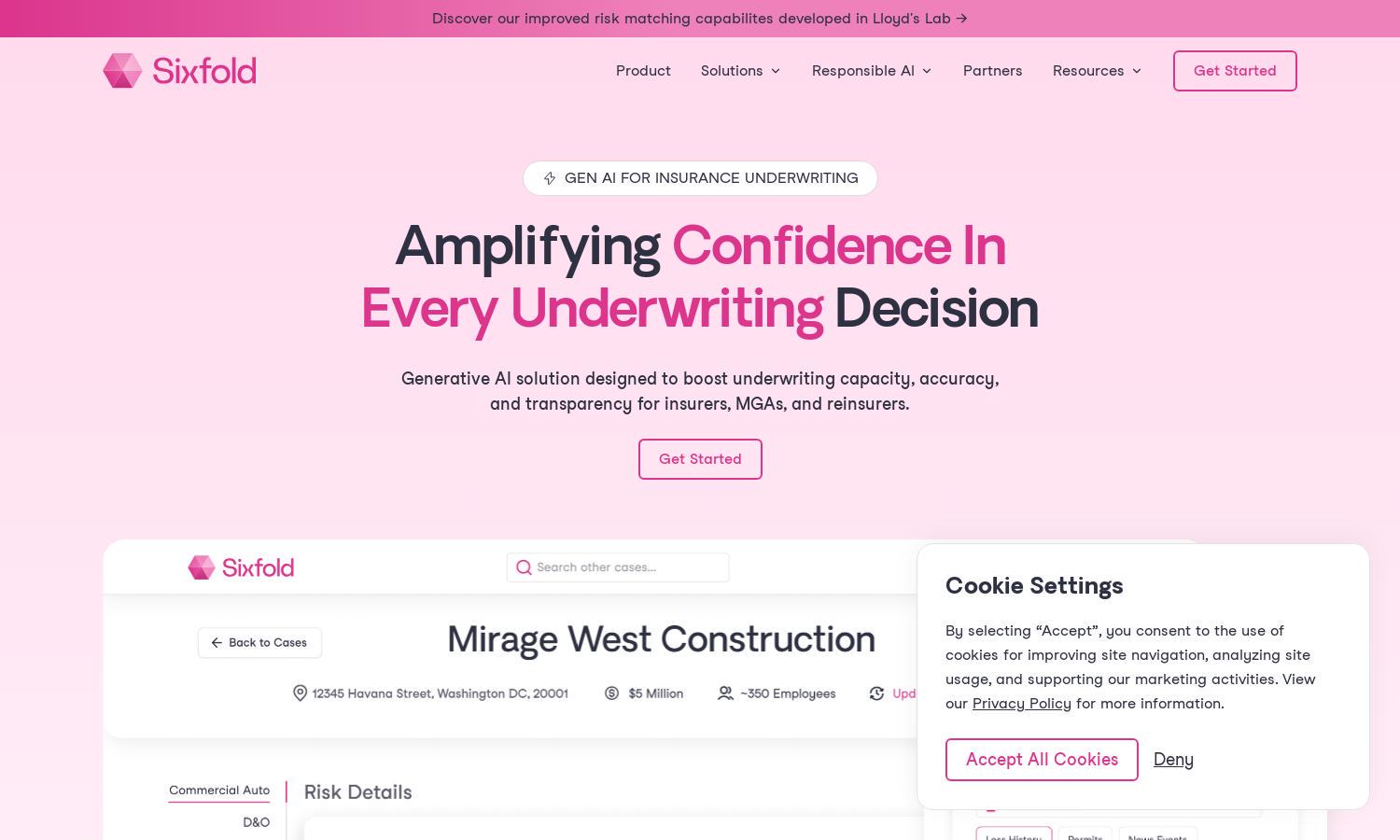

Sixfold empowers insurance underwriters with innovative generative AI tools designed to streamline workflows and enhance decision-making. By ingesting underwriting guidelines and extracting risk data, Sixfold provides tailored recommendations, enabling underwriters to tackle challenges efficiently. This transparency and automation solve the industry's complexity for improved outcomes.

Sixfold offers flexible pricing plans to accommodate diverse insurance needs, ensuring value at every tier. Users can explore different subscription levels that provide tailored solutions for underwriting. Upgrading unlocks advanced features, enhancing risk insights while ensuring compliance, making Sixfold essential for modern insurance underwriting.

Sixfold’s intuitive user interface simplifies the insurance underwriting process, ensuring a seamless experience. Users find easy navigation through its layout, enhancing productivity with unique features like risk signal detection and data summarization. The design prioritizes user-friendly interaction, making Sixfold an indispensable tool for underwriters.

How Sixfold works

Users start with Sixfold by onboarding their underwriting guidelines into the platform, which then processes and extracts necessary risk data from submissions and documents. Through its generative AI capabilities, Sixfold provides tailored recommendations, identifies risk signals, and allows users to synthesize information, making the underwriting process efficient and transparent.

Key Features for Sixfold

Automated Risk Insights

Sixfold's automated risk insights feature revolutionizes insurance underwriting by delivering tailored recommendations through generative AI. This unique capability enhances decision-making for underwriters, allowing them to focus on high-value tasks while ensuring compliance and transparency, effectively transforming the underwriting landscape.

Transparent Underwriting Decisions

Transparency in underwriting decisions is a hallmark of Sixfold. By providing full sourcing and lineage of decisions, Sixfold ensures that every choice is transparent, fostering trust and accountability. This feature empowers underwriters by eliminating the black-box approach often associated with AI solutions.

Comprehensive Workflow Automation

Sixfold offers comprehensive workflow automation that transforms the tedious underwriting process. By analyzing diverse data sources and summarizing key risk insights, the platform enhances operational efficiency, allowing underwriters to focus on critical analysis and decision-making instead of manual data synthesis.